绿色企业的状况

进两步

绿色企业,2018的国

以下是从适于绿色企业2018国家今天出版的GreenBiz合作与Trucost公司。

“二度和SDGs。”这是新的可持续发展的业务口头禅。它押韵。你几乎可以跳舞了。

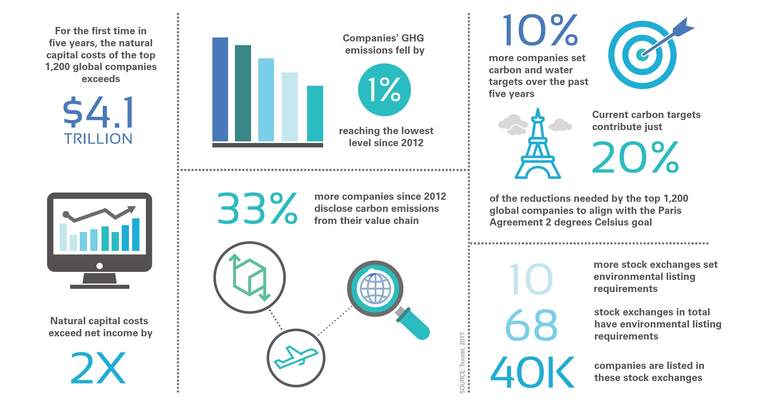

巴黎气候协议和联合国可持续发展的目标,无论是在2015年颁布的双桶冲击,终于被觉得公司开始调整其可持续发展的目标,并最终他们的行动与这些全球性的承诺。竞彩足球app怎么下载而且即使美国政府仍然在这两方面的努力持观望态度,私营部门 - 与州,市和其他国家结盟 - 是向前迈进。如果不能步调一致,至少在大致相同的方向。

事实上,公司的承诺和成就不断,在政治风向unbuffeted。领导力的公司,如沃尔玛和苹果继续提高标准 - 从大气中移除十亿吨的温室气体,在零售巨头的情况下的承诺,并承诺从回收的材料使手机完全,标志性的高科技公司。新公司和小公司正在移动,也升温了购买可再生能源,并采取其他环保措施一度被看作是世界上最大的品牌纯粹的领域。

也许最重要的是,总裁唐纳德·特朗普的就职典礼和美国的环保法规和国际承诺的后续回滚镀锌公司,以延长或加倍努力。"We Are Still In" morphed from a meme to a movement, no longer just a slogan expressing companies’ unrelenting efforts to address climate change, but now a gesture of defiance — a rare instance of the private sector coming together to take on a sitting American president. With more than 2,500 signatories — including 1,700 companies, 200 U.S. cities, nine states, 200 colleges and universities and scores of faith-based institutions — "We Are Still In" has emerged as the largest climate campaign in the United States.

这是一个好消息。故事更具挑战性的部分仍然是变化的规模,范围和速度。对于所有的企业无视,特朗普政府仍然取得了其对环境的标志 - 一个黑点,如果不是顽固,是一个污点,这将需要几年,甚至几十年,到擦除。And while the administration’s environmental agenda is purportedly pro-business, the corporate crowd seems less enthralled with ideological efforts to undo every environmental regulation and incentive program imaginable, simultaneously paving the way for fossil-fuel and other extractive companies to run amok on even the most pristine and sensitive lands.

哪里推?它不是从C-套房或会议室来了。公司说,他们有太多其他的轴与国会和总统磨 - 基础设施,移民,最低工资,医疗保健和一般意义上的世界的状态不太稳定,现在比冷战以来任何时候。以相对较少的公众压力,公司采取对气候和相关担忧大胆的立场,环保似乎从来没有上升到企业议程的首位。

Arguably, it should, and companies’ timidity someday may be seen as short-sighted, much as the failure to recognize or rein in abuses by the financial sector in the mid-2000s led to a global recession that throttled profits and productivity, and reduced shareholder value by trillions. Climate change is being seen by many — notably bankers, insurers and others whose job it is to assess and manage risk — as a threat that, if not existential, could lead to significant negative impacts to operations, supply chains, communities and the well-being of employees and customers.

跟着钱走

There are encouraging signs of an awakening, driven in part by the financial sector, which is just beginning to turn the screws in a way that could force companies to take bigger actions to stem climate change and to address society’s ills, from hunger to poverty to gender equity.

在过去的18个月左右,主流投资公司已经使他们磨练了注重环境,社会和治理,或ESG,上市公司的业绩。在某些情况下,投资者,债权人和评级团体也开始重新定义“受托责任”包括诸如公司的ESG数据或易受气候风险。

欧盟是这种想法地面零。有欧盟萌芽运动,以鼓励市场分析人士认为长期来看,鼓励养老基金在可持续发展的最佳利益行事,并提高披露,帮助投资者了解哪些投资是可持续的,这可能不是。竞彩足球app怎么下载随着时间的推移,思维去,ESG数据可以帮助确定公司的领先股票指数,如标准普尔全球或FTSE包容。

但压力被认为在美国也。在到去年11月客户的报告中,穆迪投资者服务公司解释它如何融合到气候变化纳入国家和地方债券的信用评级。外卖:如果城市和国家不与汹涌的海洋或强风暴的风险应对,借贷成本将上升。

我只想说,这可能是一个改变游戏规则,在把气候风险和其他环境和社会指标与传统财务指标和风险计算相提并论的条款。

在此期间,该消息对公司董事会是隐含的,如果没有明确的:贵公司的气候和资源风险,以及它的社会影响,包括运营和其供应链,以及它的运作地方采取股票。(Witness the harm done to businesses in communities ravaged by 2017’s hurricanes.) As Wall Street and its global brethren begin to leverage the ever-growing cache of company-specific data and algorithms — such as using artificial intelligence and satellite imagery to pinpoint which company’s facilities are likely to suffer from droughts, extreme heat and sea-level rise, among other calamities — and then make investment decisions based on that data, the changing climate no longer will be seen as external to profits and productivity.

可喜的迹象

与往常一样,无数希望的迹象指向的变化,一些地震,在可持续发展的业务的主流。对于其他环境问题最初是为解决气候变化问题,但最终 - - 基于科学的节能减排指标的增长正在帮助公司评估其承诺和成果是否足以促成有意义的解决方案。可再生能源市场,包括效率和存储,日趋完善,导致企业的增产行动他们的购买,即使在稳定的化石燃料价格的时代和不断变化的税收政策。下一代技术,如人工智能和合成生物学,正在部署一个可持续发展的世界的名字,应对大,看似棘手的挑战。

所有这一切都在监管和政策领域外发生的企业认识到,对任何公司寻求解决国际社会的集体气候和可持续发展的目标是成为筹码被视为在未来十年或二十年的领导者。

事实上,“二度和SDGs”仍有可能成为主流业务的说法。也许,有一天,我们都会跳舞吧。