The hidden risks nature loss poses for businesses

作为去年的头条新闻已经做了一切太清楚,自然是在紧急状态。

在May following the most comprehensive scientific investigation into the planet’s health,报告(PDF)政府间科学政策平台上的生物多样性和生态系统服务(IPBES)敲响了警钟,一个1万个物种面临灭绝的危险,由于人类活动。作为IPBES椅子Sir Robert Watson noted:“我们正在侵蚀着我们的经济,生计,粮食安全,健康和生活质量的根基全世界。”

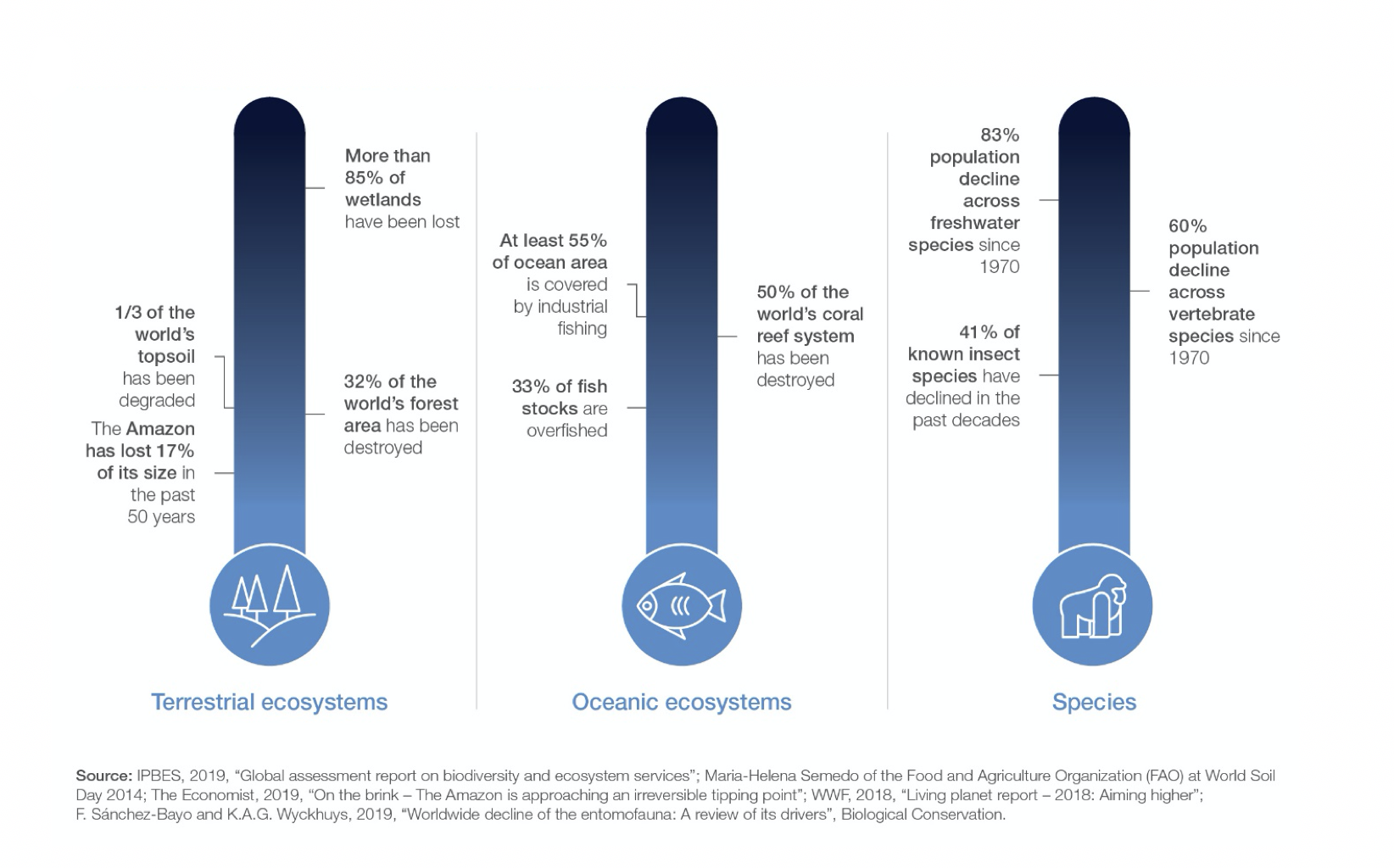

生态系统在规模和条件被拒绝47 percent globally compared to estimated baselines,and species populations have faced stark declines (see Figure 1, below).

对自然的损失敲响了警钟,在今年的高亮显示World Economic Forum Global Risks Report(GRR),其中,生物多样性丧失,对于第一年,跻身全球五大风险之一,在可能性和影响而言,在未来10年。

在boardrooms, investment and risk committees, however, nature loss still appears to be largely a hidden risk. This needs to change, and quickly.

Crossing the ecological limits of our planet will directly affect economic activities and businesses that depend on and have an impact on nature. Insufficient accounting for these risks could have unintended consequences, such as short- or long-term risk mispricing, inadequate capital buffers and, in extreme cases, the potential for stranded assets. For example, between$ 235十亿和$ 577十亿全球作物产量是有风险每年从授粉损失。

近年来,我们已经看到了政府,监管机构,资产所有者和管理者,以及 - 日益 - 企业,已经认识到气候变化对系统性金融风险。现在是时候认识到这一点扩展到自然流失所带来的风险。

在a new report by the World Economic Forum and PwC UK (PDF),率先在新自然经济系列,我们看一下大自然危机为商机的规模和紧迫性。我们强调,作为自然下降,所以做业务的增长和更广泛的繁荣前景。例如,60 percent of coffee varieties are at risk of extinction from a combination of climate change, disease and deforestation. If this were to happen, global coffee markets — a sector with2017年零售销售的$ 83十亿(PDF)— would be significantly destabilized.

根据我们的分析,44万亿美元的永川市c value generation — over half of the world’s total GDP — is moderately or highly dependent on nature and the services it provides. Industries that are highly dependent on nature generate 15 percent of global GDP ($13 trillion), while moderately dependent industries generate 37 percent ($31 trillion). This underscores the significant financial exposure to nature loss for businesses worldwide if current trends continue unabated.

It is critical that businesses regularly identify, assess, mitigate and disclose nature-related risks to avoid potentially severe consequences. One approach to doing this is to adopt the recommendations proposed by the金融稳定委员会的工作队与气候相关的财务披露(TFCD), which incorporate nature-related risks alongside climate risks within corporate risk management and disclosure.

该TCFD的建议主要集中在管理,战略,风险管理,以及指标和目标的四大主题,并可以作为企业和投资者的指导接近的性质有关的风险和机会进行管理。

对于一个企业应对自然风险的四个关键行动

1. Apply governance for nature-related risks and opportunities

与物料接触大自然损失企业应该确保他们拥有的是一种清晰的治理结构来识别和管理自然损耗所产生的风险。应该有从业务部门的风险管理委员会受够了重大风险的过程。

It may make sense to use the same governance structure as for climate-related risks and/or environmental, social and governance (ESG) risks. There should be a clear understanding of the management-level individuals or committees with responsibility for nature-based risks and how and when they interact on the issue at all levels within the organization.

2.一体化性质有关的风险和机遇转化为组织的战略和财务规划

每个组织了解它是如何预计自然有关的风险,随着时间的推移和使用该通知业务规划和战略是非常重要的。

企业应该披露什么性质的风险和机会,他们在其价值链暴露,以及如何这些可能会影响未来现金流量和资产价值。这包括通过持续性亏损驱动可能的情况下的财务后果,这可能包括对自然资本的下降,以及在监管,市场的变化,以及法律和声誉问题,对身体的影响的评估。

Businesses can then decide what type of strategy is appropriate to manage nature-related risks and how they can create opportunities.

3. Identify, assess and manage nature-related risks as part of enterprise risk management processes

管理性质相关的风险必须作为战略和管理一个强大的过程。企业应确定跨物理,规章和法律,市场和声誉风险的主要类别的性质相关的风险到他们的业务,产品和供应链。

企业应该进行实质性评估,以了解其风险可能是最显著,值得集成到核心的企业风险管理(ERM)系统。希望采取更成熟的做法的企业将进行关键的风险和机遇,其中包括财政方面量化了详细的评估。

4. Identify and track nature-related risk metrics and targets

发展指标和目标是至关重要的企业进行有效监控的性质有关的风险和评估对他们的战略方面的进展。关键指标将通过行业不同,虽然有可能是已经被报告与气候相关的指标(例如,水,土地使用,森林砍伐和新料使用)有些重叠。

Figure 2, below, summarizes a nature risk management framework for businesses, including a basic and a mature approach.

它的时候,自然风险向上移动商务和经济决策者的议事日程。我们不能扭转行业没有发挥关键作用自然损耗;和行业不能忽视的自然危机。新的承诺,新政策,新商业模式和新的解决方案迫切需要保护和恢复自然和激励的可持续利用。

本文最初出现在世界经济论坛博客。