Fossil fuel giants are failing to disclose investor risk, study warns

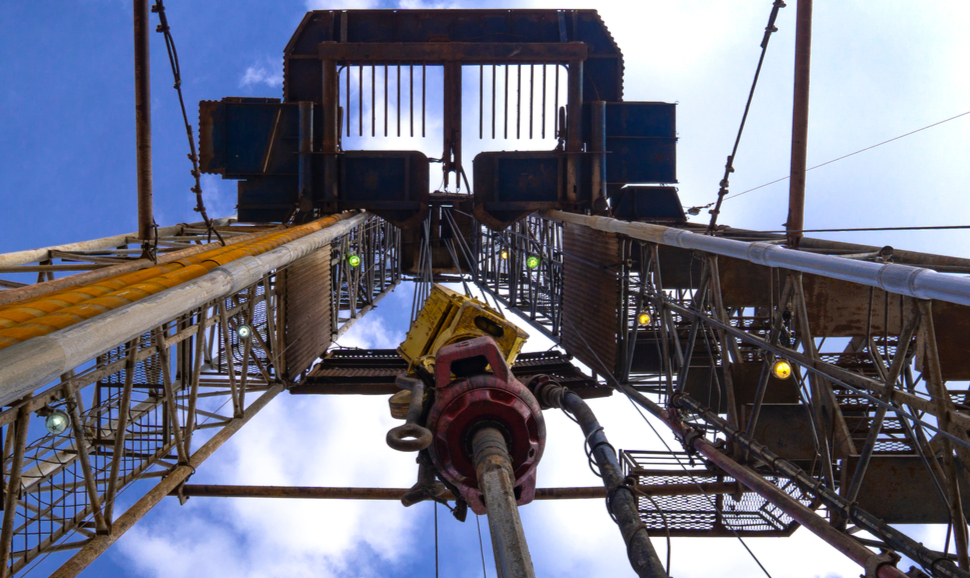

从下方观看的油钻机。

Oil and gas firms are largely failing to disclose the information investors need to accurately assess their exposure to risk associated with climate change and the transition to a low carbon economy, according to areportpublished last week by financial think tank Carbon Tracker.

这一发现是一系列研究中的最新一项警告,该警告说,能源部门暴露于数十亿美元的所谓过渡风险,因为世界与低碳经济息息相关,符合巴黎气候目标。

化石燃料公司在很大程度上取决于未来收入,以发现和利用碳氢化合物资源,这一过程需要大量的资本支出。但是,正是这些未来的资源和储备金最大的风险在一个不断在2摄氏度下变暖的世界中被困在摄氏2摄氏度下的世界中,该研究“报道了安全的气候”。

The analysis concludes the corporate disclosure practices intended to render transparent the risks a company is exposed to — and the actions they are taking to mitigate these risks — are lacking in this crucial area, leaving investors unable to make informed decisions.

"The long-term financial impacts of climate change are clearly material to the upstream oil and gas sector, yet current company disclosures do not go far enough to communicate the extent to which their capital expenditure plans are addressing this risk," said Robert Schuwerk, executive director at Carbon Tracker.

Its conclusions are likely to accentuate investor concerns, which already have been heightened following a series of recent studies highlighting incompatibilities between fossil fuel investments and international commitments to slash carbon emissions.石油和天然气部门的支出计划与限制气候变化非常不相容。

非政府组织全球证人上个月发布的分析确定了4.9万亿美元的计划投资在探索和从新领域提取的投资“与实现世界气候目标不相容”。

全球证人高级竞选人默里·沃西(Murray Worthy)表示:“投资者将正确地担心,尽管行业违反行业的言论,但石油和天然气部门的支出计划与限制气候变化的巨大不相容。”

以前的Carbon Tracker analysis如果政府政策被收紧到达到巴黎协议所需的程度,则确定面临滞留的1.6万亿美元投资,该协议承诺保持低于2度的温暖。

Meeting these targets will require a "rapid and far reaching" transition across the economy, according to the United Nations' most最近的报告on climate change. Astudy (PDF)今年早些时候,由34个中央银行和主管的联盟绿色金融体系网络(NGFS)概述了与过渡相关的气候风险,概述了1万亿至4万亿美元的潜在损失。

该碳追踪器报告得出的结论是,如果投资者能够准确评估这些风险,则需要确保与预期的勘探和开发活动中预期资本支出以及基于公司上游战略的假设有关的预期资本支出。

"Investors want reassurance that upstream oil and gas companies are factoring climate-constraints into their capital expenditure strategy. We believe that they could be doing a lot more to communicate this to their investors," said Kate Woolerton, lead author of the report.

Responding to the report, Jeanne Martin, senior campaigns officer at pressure group ShareAction, said: "Oil majors are failing to come clean to investors about whether their assets will be stranded in a below 2 C world. Is that because increased transparency would reveal that these companies have no intention of driving the low-carbon transition, as claimed in their glossy sustainability reports?Two thirds [of fund managers] want to switch their investments to low-carbon solutions.

"With the 2019 AGM season in full swing, investors should use their full shareholder rights to support climate shareholder resolutions and vote against boards that continue to demonstrate inaction on climate change."

There are growing signs that some investors are responding to this call. Asurveyof fund managers responsible for $10 trillion of assets, found this week that 86 percent of managers wanted oil firms to align with the Paris 2015 U.N. goals, while two-thirds want to switch their investments to low-carbon solutions.

Meanwhile, leading German corporate giants RWE and BASF last week responded to calls from activist investors at the Climate Action 100+ group to confirm they would undertake a full review of their lobbying activity to ensure it is supportive of the goals of the Paris Agreement.

"Union Investment highly appreciates BASF's and RWE's positive first responses to the IIGCC/Climate Action 100+ engagement," said Henrik Pontzen, head of ESG at Union Investment. "Transparency is a prerequisite for making good and informed investment decisions. We therefore very much welcome the important commitments both companies have made to review and publish the results regarding the Paris Agreement alignment of their lobbying activities."

Carbon intensive businesses can expect calls for greater reporting transparency to continue to intensify as more and more investors wake up to the stranded asset risks that have to date been hidden in their portfolios.

This story first appeared on: