The business guide to green power: 12 ways to invest in renewable energy

OurGreenBiz Evergreen columnbrings to light GreenBiz stories from the past that remain relevant today. If you scratch your chin over RECs and PPAs, this corporate renewables buying guide has been defining the details since it originally ran in November 2015.

Do you want those RECs bundled or unbundled? And will your PPA be physical or virtual? Have you even thought about the annual financial implications of the ITC?

For the uninitiated, the variety of ways companies can throw their weight into the market for renewable energy quickly starts to devolve into alphabet soup.

Still, with more companies setting sustainability targets or eyeing falling wind and solar costs with heightened interest, replicable models for businesses to invest in renewable energy projects are increasingly in demand.

The key thing for businesses is to figure out what they want to get out of it.

But we’re not talking about just any green energy certificate of participation. More businesses arefocusing on the concept of "additionality,"or making sure their money truly makes a dent in new renewable energy capacity — especially as the financial conditions for investment are also becoming more favorable.

"The landscape has changed a lot in the last two to four years," John Powers, vice president of business development for clean energy broker Renewable Choice Energy, told GreenBiz. "In certain regions of the U.S., it is cheaper to lock in long term agreements with fixed rates that are significantly less than what power trades for in those same markets."

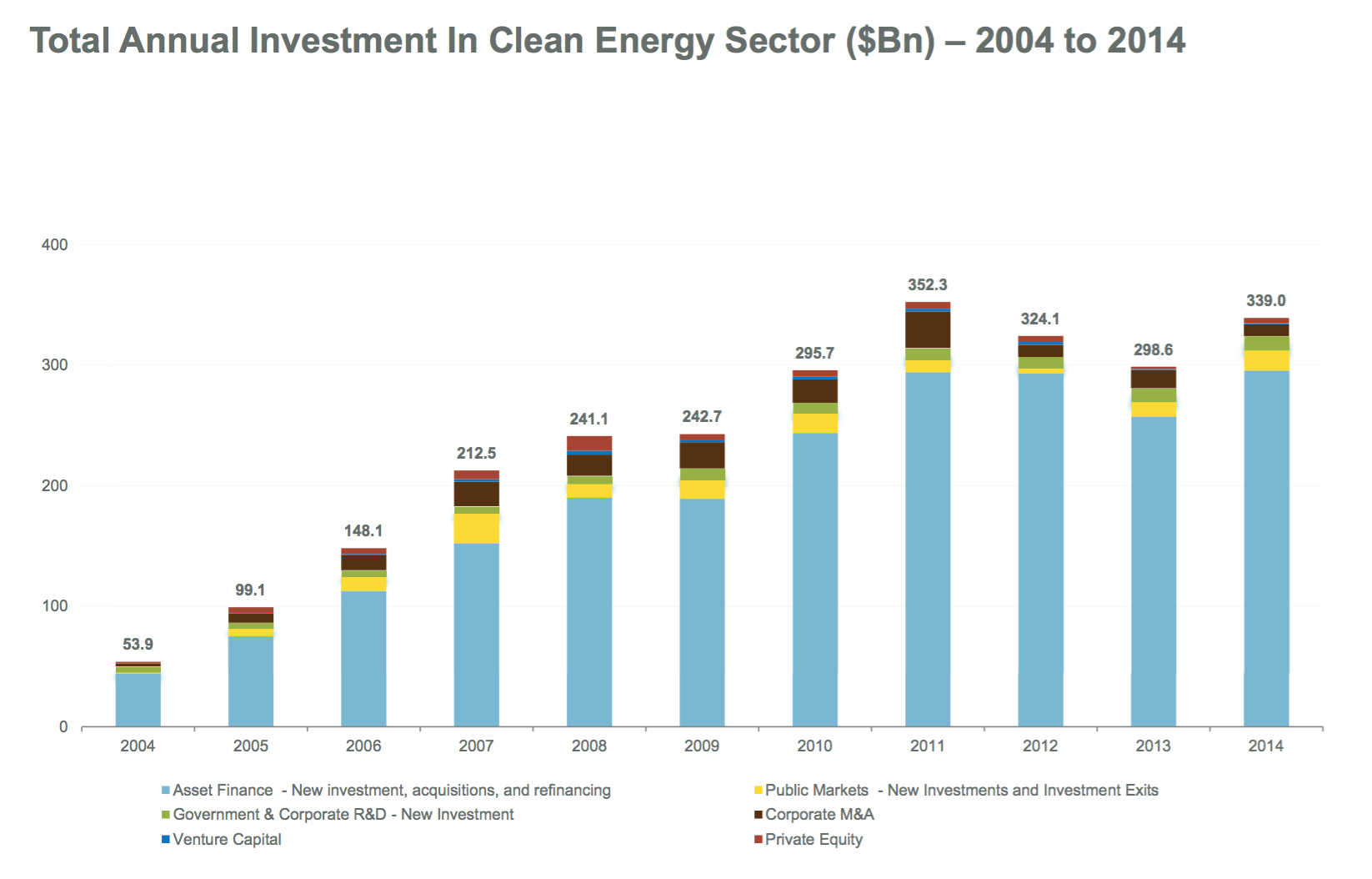

As the American Council on Renewable Energy (ACORE)has illustrated,投资在清洁能源many forms and has increased at variable rates over the last decade.

Clean energy advocates have attempted to seize on an investment climate made more appealing with the example of highly visible companies executing multimillion-dollar deals, such as Walmart, Ikea, Apple and Google.

Activist groups such asGreenpeace, along with more business-friendly NGOs, such as theWorld Resources Institute,World Wildlife FundandRocky Mountain Institute, are increasing their calls for action. The newClean Power Planand upcomingCOP21 United Nations climate talksadd to the urgency, with groups such asCDP,We Mean Businessand theRE100signing businesses up for clean energy commitments.

Still, realizing that there may be an opening to invest in clean energy isn’t the same as hammering out a coherent strategy on renewables.

For one, renewable energy deals that are becoming more popular in some states areimpossible to replicate elsewheredue to the way power markets are regulated. Challenges such as sustainability budget constraints, limited manpower or unclear environmental commitments also can come into play.

"The key thing for businesses is to figure out what they want to get out of it," said Jennifer Martin, executive director of green power standard-setter the Center for Resource Solutions. "If you’re manufacturing consumer goods, you don’t want to have to develop a whole energy business."

对于那些对市场营销和reputati感兴趣onal benefits of buying clean energy, "green tags" or credentials linked to carbon credits or offsets, could suffice. Those interested in reducing exposure toenergy pricing volatility经常致力于长期的可再生能源procurement deal. Others are exploring the potential returns on clean energy equity investments.

"There’s definitely a growing sophistication among buyers of renewable energy," Powers said. "To respond to that, we need a growing sophistication in product offerings."

Green tags

Green tags, Renewable Energy Certificates, Renewable Energy Credits, Renewable Electricity Credits, it’s all the same concept: ensuring that a company gets credit for supporting renewable energy.

Martin, whose nonprofit Center for Resource Solution sets the standards for what qualifies as a REC through itsGreen-e program, said that RECs serve as a paper trail for clean energy.

"RECs are really the accounting mechanism for tracking who uses renewable energy at the end of the day," she said. "No matter what kind of transaction you’re doing … the RECs need to flow from the generator to the end user."

In some states, many of them concentrated in New England, energy utilities face highRenewable Portfolio Standards(RPS)that increase pressure to obtain renewable energy credits. While the supply of RECs has constricted in markets such as Massachusetts, with solar going for several hundred dollars per Megawatt hour (Mwh), states with either no standards or an excess supply of RECs have resulted in depressed prices.

No matter what kind of transaction you’re doing … the RECs need to flow from the generator to the end user.

The issue of additionality — that a project wouldn't be built without investment from a certain company — arises when the price of RECs drop so low thatit becomes difficult to determinewhether purchasing the credits actually will add to renewable energy capacity. In addition to the wide regional variation in pricing, Martin said that the debate over additionality can sometimes miss the point.

"What businesses want to do is be able to tell a story about renewable energy," she said. "What they’re trying to do is show that they made a difference."

Similar logic often extends to carbon offset projects designed to compensate for emissions.

"The business case for either buying RECs or offsets is because you want to make an environmental impact, or make certain claims that are important to you, your shareholders or your customers," Powers said.

1. RECs

Anyone that wants to claim that they are using green power, even in the case of a company that directly procures their own energy in the form of on-site systems such as rooftop solar, will involve a REC to document who is using the renewable power.

Thepricing for RECs, however, can vary from less than $1 per Mwh to hundreds of dollars due to the regional supply and demand equation dictated by portfolio standards and clean energy supply. The reason RECs can get so competitive in markers with high portfolio standards is the specter of a compliance payment if the targets aren't met.

"They’re hugely variable by region," Martin said. "One of the things that is going to change the calculus is the new Clean Power Plan. It could be very beneficial for the state to increase the amount of renewable energy."

2. Unbundled RECs and REC swaps

One quirk of the REC system is that the credits can be traded. They are considered "unbundled" when the certificates are sold separately from the physical energy produced. For example, a company may want to buy energy from a remote solar farm, where the energy is sold to a third user or utility, with the company still claiming the RECs.

"Where unbundled RECs get criticism is in the argument around additionality," Powers said. Because a REC is about the intrinsic value of producing energy in a clean way (with negligible or no carbon emissions), they may be sourced from a large, long-established wind farm, as opposed to being financially additional to a brand-new power producer.

To this end, Martin noted that one element of green power guidelines in flux is "the new date," or how long renewable energy developments can be considered new enough to warrant credits. The current standard is 15 years, and the proportion of clean power required within a development also has been clarified over time.

3. Carbon offsets

On a fundamental level, carbon offsets are a way of paying for infrastructure projects that reduce net carbon emissions. They are useful because it is often impossible for a business to not produce any carbon, meaning that offsets are used to balance out greenhouse gas (GHG) impacts.

A variety of offsets can mitigate GHGs, from planting trees that sequester carbon to corporate energy efficiency programs or preventative measures that generate varying degrees of controversy, such as flaring leaching methane gas from unregulated landfills.

Power purchasing

Buying renewable energy to power a corporate office is nowhere near as easy as picking a provider and signing a contract.

In deregulated energy markets, customers can buy retail wind or solar and slap it right on the company real estate. Or, they can sign a long-term deal to buy the power generated by an off-site renewable energy plant.

In regulated utility markets, things can get complicated fast. Deals are more theoretical and often rooted in hedging energy prices. The outcome of providing capital to finance new renewable energy capacity is the same.

"The corporate buyer —Google, Walmart, etc.— they’re providing that structured and guaranteed revenue for a long period of time that allows a bank to say ‘OK, I’ll loan you $200 million to build this thing,’" said Peter Mostow, an energy attorney with the law firm Wilson Sonsini Goodrich & Rosati.

The corporate buyer ... they’re providing that structured and guaranteed revenue for a long period of time that allows a bank to say ‘OK, I’ll loan you $200 million to build this thing.'

Still, the barriers to entry for various types of power purchasing remain high, feeding into interest in new forms of aggregated clean energy developments.

With all of these deal types, much bigger energy diplomacy concerns also come into play.

"This is really contentious territory," Mostow said. "You’re striking right at the heart of the utilities’ business models."

4. Physical PPAs

Say you're a company that wants to buy electricity generated at an off-site wind or solar farm to power a given real estate asset. If you're game for a 12-15 year commitment, a Power Purchase Agreement (PPA) could be your answer.

"A regular PPA, they never say it, but its sometimes called a 'physical delivery PPA,'" Mostow explained. “Electricity is actually being generated at point A, moved across the wires, and delivered at Point B."

(At least that's the idea logically speaking. As Mostow noted, "In reality, the electrons that are generated at a solar plant never actually go to the customer. The grid is a big giant balancing or accounting system.")

Regardless of where the electrons land, a company's commitment to buy power for a term usually longer than a decade helps a renewable energy developer and potential lenders ensure that there will be a buyer for their power.

5. Virtual PPAs

Physical PPAs can work in California or other deregulated energy markets, but they can't work in regulated markets with tight limitations on who is able to sell power.

As a workaround, companies, renewable energy developers and third party brokers have devised "virtual" or "synthetic" PPAs as a way to reap the financial and reputational benefits of PPAs — but without any power actually changing hands. While a company still powers its operations with grid-supplied electricity, both they and the developer benefit from a long-term fixed cost deal on energy generated from a project (which can be physically located anywhere).

Say the agreed-upon rate for a wind farm VPPA is $40 per megawatt. If the wholesale rate for energy generated by that project drops to $30 on a given day, the developer is buoyed by the extra $10 from the corporate buyer. But if grid prices spike and going rate for wind power jumps to $50, the scenario is reversed and the corporate buyer gets the extra $10.

"That $10 helps the corporate customer offset the utility bill that they're paying at their data center of wherever," Mostow said. "It's a hedge for them, too."

Powers adds that virtual PPAs also make sense strategically for businesses with a highly distributed power load, like a slew of retail stores, or if facilities are leased instead of owned.

6. Aggregated purchases

One obvious pitfall for PPAs is the high financial barrier to entry, with utility-scale renewable energy developments usually carrying a price tag well into nine figures. If that's out of the question at any one company, what about pooling resources in an aggregated or syndicate-style deal?

"Think about it as getting people together and buying in bulk together," Powers said.

而与五平等各方敲定一笔交易is possible in theory, he noted that coordination can be difficult because "this is a CFO-level decision at every company that’s making it." Alternatively, having an "anchor" company — or one company willing to take on the bulk of the investment and then sell off smaller stakes as PPAs — also could work.

7. On-site power

While PPAs deal with utility-scale solar, corporate customers operating in deregulated markets also have the option of buying or leasing a renewable energy generation system (often solar) for on-site use. Adobe, Coca-Cola, Google, Kaiser Permanente and Kohl's areamong those pursuingthese arrangements.

"On the on-site solar side, the commercial and industrial segment has been a bit underserved," said Hervé Touati, managing director of RMI's Business Renewables Center. "It has not seen the same growth as the utility segment or the residential segment. I think that will be corrected."

Equity investment

As with most emerging markets, the evolution of clean energy has brought with it more variation in the financial maneuvers that companies and investors seek out to make money on a trend.

One of those avenues is equity investments — a tack taken by companies including Ikea and Google, Touati said — which vary in structure but share a common emphasis.

Energy is not a high margin business. It’s an infrastructure business.

"There are few companies that have done investments," Touati said, which differs significantly from actually buying renewable power. "One is about making money off investments, and the other is about procuring green energy."

Uncertain returns, however, can be a dealbreaker.

"The thing about energy as an investment is that energy is not a high-margin business. It’s an infrastructure business," Mostow said. "I’ve seen a lot of my corporate clients look at maybe we should just be equity investors. It doesn’t usually meet their hurdle for investment."

8. Venture capital, private equity or stock purchases

More direct is the option for various investors or corporates with available capital to invest in privately held clean energy companies (a $5 billion market as of 2014, according to ACORE), or to buy stock in those that already have gone public (an $18.7 billion segment last year).

At the project level, another option is to be a stock or equity investor in a solar or wind farm.

9. Tax incentives

One key variable in the case for renewable energy equity investment is the federalInvestment Tax Credit (ITC)currently offered to renewable energy project owners and investors.

The catch: With the 2006-era policy set to expire for residential solar in December and the commercial credit slated to drop from 30 percent to 10 percent, uncertainty about the future of this revenue mechanism is starting to loom larger.

10. YieldCos

In the lexicon of green energy, public entities created to own renewable power projects and deliver returns in the form of dividends — a class known as YieldCos — have started to come on strong in recent years with larger renewable energy companies such as SunEdison. The new packaging of clean energy investments isn’t coming without growing pains, however, and has in some ways lumped renewables into broader volatility.

"Investors have stepped up to finance a host of energy-related products in recent years, contributing to a glut in supply that has spurred a dramatic collapse in commodities prices," Bloombergrecently reported. "That's helping to fuel additional market scrutiny of commodities' players — from giants such as Glencore to U.S. shale explorers and even solar panel operators."

11. Green bonds

On the lower-risk end of the spectrum,绿色债券— or government bonds tied to projects designed to combat climate change — are an area that clean energy advocates have been hopefully watching for years.

Often pitched as a way for smaller investors to contribute to daunting infrastructure financing, the market is expected to exceed $60 billion. Up next: settling on what really counts as green infrastructure and testing investors’ appetites for continuing to grow the market.

12. Securities, mutual funds and beyond

While equity investments are more universally understood financial arrangements, more esoteric mechanisms associated with Wall Street are also making their way into the market for clean energy.

Goldman Sachs claims credit for the first rated "securitization" of solar energy, or converting an illiquid asset into a security, for a Japanese bond project. Investing in mutual funds that include an increasingly broad array of renewable energy options is another option.