雀巢,可口可乐披露水风险的公司首席名单

Climate change, water shortages and pollution pose severe risks to the $5 trillion food and agribusiness industry.Agriculture consumes70 percent of freshwaterand contributes about one-fifth of greenhouse gas emissions globally — and the sector is growing rapidly to support a population nearing 9 billion by 2050. The responsibility to balance growth with water supply and negative environmental externalities is heavy.

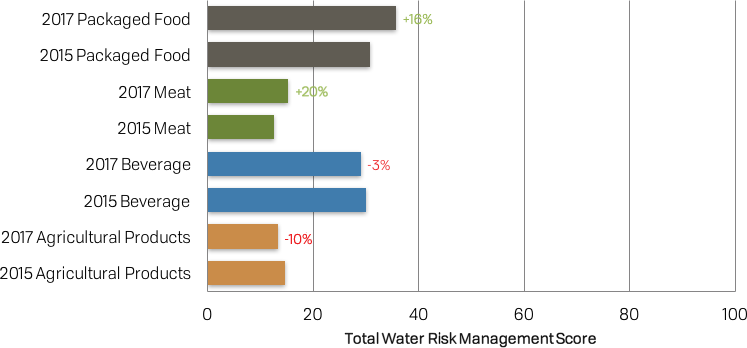

在第二个Feeding Ourselves Thirstyreport,nonprofit investor coalition Ceres found that the food sector's management of water risks improved by 10 percent on averagesince its last report in 2015。包装的食物和肉类部门取得了最大的改进。

The sector is still getting its feet wet, however: the average score for the largest global 42 food and agriculture companies in the report was only 31 points out of 100. Meat and agricultural producers lagged behind the packaged food and beverage industries.

总体而言,“水管理对于从未像现在这样的公司都是必须的,”该报告的合着者,CERES农业水管理计划的负责人伊丽莎·罗伯特(Eliza Robert)说。“随着缺水和污染的不断增加,公司领导人必须防水业务,以保护和维持水供应。”

该报告衡量了42家最大的上市公司对水依赖,水安全和管理淡水供应等变量的反应。两家公司被分为包装食品,农产品和肉类类别。Ceres使用公开可用的数据进行了分析,例如10-K文件和可持续性报告竞彩足球app怎么下载-判断他们在治理和战略方面的水管理方面的表现;直接操作;制造供应链和农业供应链。

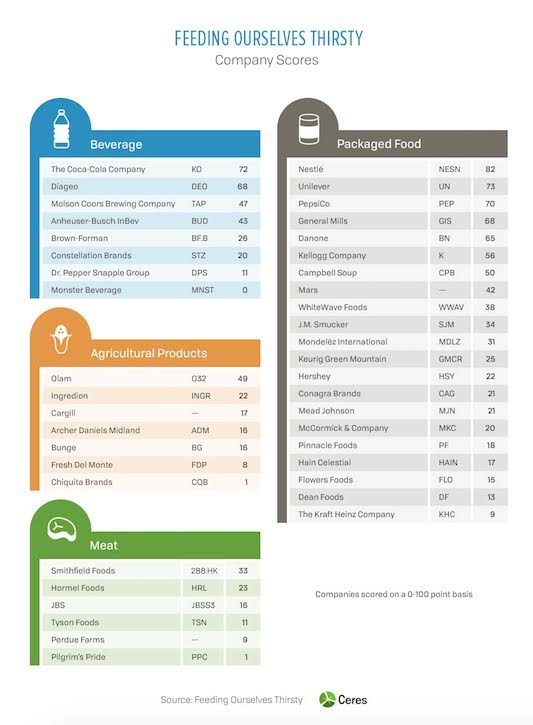

The top-scoring brands were Nestle (82 points, up from 64 in 2015); Coca-Cola (72 points, up from 67); meat manufacturer Smithfield Foods (33 points, no change from 2015) and Olam, a newcomer to the report. "Winners" in the beverage and meat industry were unchanged, but in packaged foods and agricultural products, Nestle and Olam usurped Unilever and Bunge.

得分最高的人要么提高其表现,要么与上一报告保持不变,而一些表现较低的品牌的排名进一步下降。例如,Chiquita在2015年获得20分,但在2017年获得了单点,这意味着它几乎没有披露有关水风险管理的任何信息。怪物饮料获得了零积分,比2015年的一点下降。

"For these companies, there is little information available about what they are doing," said Robert. "If there's no disclosure, there's not much for us to go off." Monster Beverage did not respond to GreenBiz's calls to comment on its report rankings.

Water management is an imperative for companies like never before.

数据和披露可帮助投资者预测公司风险敞口,并将公司与同龄人进行比较。罗伯特说,对该特定报告的数据的需求来自CERES的投资者网络,价值数万亿美元。

她说:“投资者需要知道我们即将结束廉价,丰富的水。”“这将改变对季度增长的期望,公司需要从根本上重新考虑其水风险。”

Key trends that Ceres found were improved water risk management as part of business strategy, along with water targets, accounting, risk assessment and sustainable sourcing programs. On the other hand, corporate governance and board oversight have stalled.

Corporate governance

该报告发现,与高管薪酬相关的水风险从2015 - 2017年提高了150%,可持续性的董事会监督提高了13%。竞彩足球app怎么下载但是,高级高管对水风险的监督下降了5%,董事会简报和董事会宪章中的水的明确提及仍然是平坦的0%。

坎贝尔(Campbell's),可口可乐,帝亚吉奥(Diageo)和雀巢(Nestle)是仅有的四家公司,该公司定期向水问题简报,其中首席执行官和董事会获悉了环境指标,例如用水量。

院长食品,莫尔森·库尔斯(Molson Coors),J.M。Smucker和Whitewave Foods(现已合并为Danone Whitewave)等公司揭示了C-Suite高管的补偿与水效目标之间的混凝土联系。

Other companies, such as General Mills, performed well on some markers (it scored above 30 points on agricultural supply chain) but were knocked back by others, such as governance and management (hovering around 10 points).

该报告发现,与高管薪酬相关的水风险从2015 - 2017年提高了150%,可持续性的董事会监督提高了13%。竞彩足球app怎么下载

General Mills应用可持续发展经理Jeff Hanratty说:“试图将水风险融入到各地的供应链管理中。”竞彩足球app怎么下载“与温室气体不同,水是区域特异性的。”将风险和水资源管理缩小到九种关键成分,这有助于该公司专注于有效更改钥匙,水密集型成分。

On governance, however, "we may not have been clear on how we manage supply chain risks in our companies" in the publicly disclosed information on which the report was based, he said.

Hanratty说,该报告是一个机会,可以看到该公司在供应链中的水风险管理方面表现良好,但是对目标和进步进行沟通可以使公司成为农业和食品部门的领导者。

他说:“我们需要公开谈论这一问题。”“如果我们可以成为[水]地区的领导者并将其他公司带入,那么大食物就会非常好。”

Investor demand

CERES报告还显示,在最近的10K档案中,有超过三分之一的公开持有的公司并未提及与气候相关的水风险,尽管MSCI已发现全球,大约在全球范围$460 billionof revenue is at risk from lack of water availability for irrigation or animal consumption and $198 billion is at risk from changing precipitation patterns affecting crop production.

According to a study produced by MIT in July, climate change will deplete U.S. water basins and降低灌溉作物产量到2050年,公司已经感觉到水风险的影响。

Last summer, Tyson Foods (which scored 11 on the Ceres report)关闭肉类加工厂because of diminishing production in the Southwest. And recently, Hurricane Harvey's 50 inches of rainfall德克萨斯州的农业部门损坏, not to mention that floodwater can contaminate food and water stocks.

面对这种波动,投资者正在对不透露其水风险监督的公司采取强烈立场。2016年,一组管理2.6万亿美元资产的机构投资者demanded that major food and beverage companiesreveal water risks and what they are doing to manage water resources.

In a statement provided to Ceres, Anne Sheehan, director of corporate governance at CalSTRS, said that large institutional investors are using risk benchmarking to reassess engagement with the low-scoring companies held in their portfolios in order to retain a competitive advantage in the market.

“有一个业务案例,可以很好地管理水风险,”Tri-State Coalition for Responsible Investment,由40个机构投资者组成的联盟,其投资组合规模从2000万美元到数亿美元不等。“是大型水用户的公司更容易暴露。水是成分的关键意见,它与运营有关,也是社会许可证运营的一个因素。”

Investors are taking a hard stance on companies that don't disclose their oversight of water risks.

该组织的危险信号是CERES投资者网络的一部分,包括缺乏负责环境,社会和治理问题(例如水管理)的董事会成员,或者没有设定水管理时有限的目标。

However, Gallagher understands that each of these gaps arises because of the challenges that disclosure and climate action pose to corporations.

"It's becoming more common for companies and proxy statements to disclose, but there is a lack of tools and frameworks to adequately manage water risk," Gallagher said.

In order to help increase water management while ensuring successful returns, investors can help catalyze the food and agriculture sector by engaging with companies to manage their risks, and urge them to work across the sector with different stakeholders to find solutions.

她说:“例如,我们通过泰森食品提出了有关水管理的股东提案,每年我们都看到代理业绩不断增长。”