根据latest U.S. government inventory, solar will account for 39 percent of the electric generation capacity added in 2021, and wind will constitute a further 31 percent.

With current technology costs and policy incentives,毫无疑问,可再生能源是最便宜的一代资产建造和操作。新的补贴风能的升级成本是更便宜比当今低成本天然气的运行现有化石资产的边际成本相比。(水平的能源成本或LCOE是指每兆瓦小时生产的一代资产的寿命成本。)公用事业规模太阳能的LCOE实际上是随着现有天然气生成的清洗。

Given these numbers, it comes as no surprise that developers have been rushing to deploy renewable energy projects. However, utilities have lagged behind in this race, especially with regard to solar.

Regulated investor-owned utilities (IOUs), public power agencies and cooperativesowned around 55 percent2019年美国的总发电能力和剩余煤炭产能的75%。但是他们只拥有15%的风和公用事业尺度太阳能的11%。尽管可再生能源的成本较低,但公用事业仍在提出建立新的化石燃料能力。

尽管较便宜的风和太阳能,但为什么公用事业公司仍继续投资化石资产?答案的一部分在于税收法规,以防止公用事业有效使用联邦政府最重要的清洁能源激励措施。可再生能源的增长是由政策工具(例如太阳能的投资税收抵免(ITC))和生产税收抵免(PTC)和ITC驱动的。这些激励措施提供了一种信贷,资产所有者可以用来抵消他们应欠政府的税款。

Perverse incentives for utilities

但是,ITC和PTC很难使用公用事业。非营利性的公共电力机构和许多合作公用事业根本不缴税,因此他们没有税收抵免的抵消。大多数营利性公用事业都利用了以前的税收优惠措施 -特别是,在过去的二十年中,国会反复采取的额外折旧措施以打击经济不景气- 并且已经可以使用前几年带来的净营业损失来抵消多年来的应税收入。即使营利性公用事业可以利用税收优惠措施,也称为“税收正常化”的法律限制也要求他们保留ITC对投资者的收益,而不是将其传递给客户。结果是不正当的:旨在加速清洁过渡的相同税收激励措施导致公用事业抵抗向太阳和风的开关。

即使营利性公用事业可以利用税收优惠措施,也称为“税收正常化”的法律限制也需要他们保留ITC对投资者的收益,而不是将其传递给客户。

公用事业必须在能源过渡中发挥领导作用。到2035年,达到总统乔·拜登(Joe Biden)表示的100%清洁电力的目标是美国必须实现其承诺50-52%的温室气体减少below 2005 levels by 2030. Although the scale of renewables deployment in 2021 is exciting, the president’s clean electricity goal requires an even faster pace. Properly incentivized, utilities can drive the renewables growth needed to meet Biden’s climate change policy goals.

我们结构税收激励措施的方式进行了两个简单的更改,可以释放可再生能源的部署,以实现这些雄心勃勃但至关重要的目标所需的速度行动:

- Eliminate tax normalization for the ITC, and allow the PTC in lieu of the ITC

- 提供税收抵免的直接工资

消除ITC的税收归一化,并允许PTC代替ITC

Normalizationis a legal restriction within the tax code that compels regulated IOUs to keep the benefits of the ITC largely for their investors. Customers are allowed only to receive a fraction of the financial value of the credit, attenuated over the long operating life of their solar assets. In contrast, unregulated entities — such as renewables developers — are free to pass on the benefits of the ITC to their customers as dictated by market competition, a more economically rational way to balance the interests of investors and consumers. Put simply, because unregulated developers are not subject to normalization restrictions, they can sell electricity at lower prices, even when technology and capital costs are the same.

这种定价劣势使ious保持一致 - 将电力出售给nearly 50 million households and 7 million business accounts在内布拉斯加州以外的每个州,都反对太阳能发展。公用事业反对派可以通过监管如何做出投资决策并赚取利润来解释。在建造电厂之前,必须向其监管机构证明投资是审慎的,考虑到相对于其他所有权选择的成本。规范化规则使公用事业拥有的太阳能项目对纳税人来说更昂贵,因此与第三方资产竞争的可能性较小,而第三方资产可以在没有规范化罚款的情况下进行定价。

Third-party solar power purchase agreements are unattractive for IOUs, which earn profits for their shareholders by investing in and owning assets. IOUs, therefore, lack the financial motivation to accelerate solar deployment. Even if a particular IOU’s parent company owns an unregulated solar developer, its investors are likely to negatively view a shift of assets away from their low-risk regulated business to higher-risk unregulated assets. In this context, the IOU’s financial interests are likely best served by resisting the transition to solar.

消除对ITC的税收归一化限制将使使太阳能开发有益的动机对IOU有益。这种简单的变化可以有意义地加速向美国气候目标的进步,并降低全国人们的电力成本。

提供税收抵免的直接工资

直接工资是一种财政机制,它将允许公用事业以资产获得的税收抵免的价值从政府那里获得现金支付(或者如果资产所有者是纳税人),而无需考虑当前税收能力。

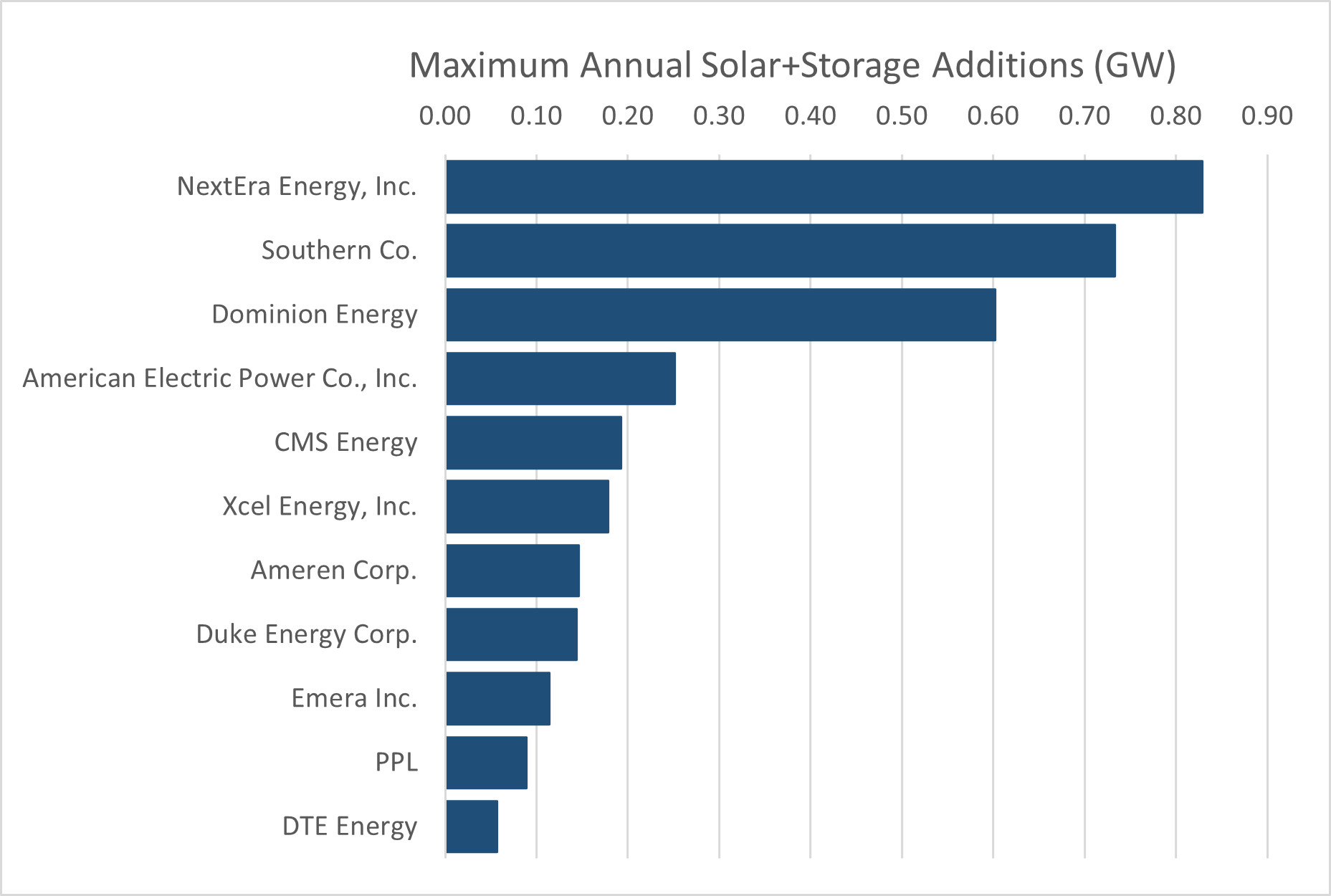

根据现行法律,公司只有在缺少信用额的情况下,他们才能在那年缴纳税款。否则,必须将信用额提升为可能的未来使用。RMIanalysis of financial disclosures表明,在2019年,美国共同的税收负债足以建造每年不到4吉瓦的新太阳能和储藏量,足以替代一两个燃煤电厂。

The reason IOUs pay so little in taxes is that, over the past two decades, policymakers have put in place "bonus depreciation" provisions that incentivize investment to fight recessions. These provisions allow companies to immediately deduct as an expense some or all of the investment they make in new capital assets from their income for calculating their taxes in that year. As a result, growing utilities that are building assets have reported large net losses for tax purposes that are likely to offset any taxable earnings they may have for many years to come.

The not-for-profit utilities that serve more than 25% of US customers see a much lower economic benefit from switching to clean energy than even a comparable for-profit utility (with or without tax capacity).

因此,公用事业通常不足以纳税,无法从现有的ITC和PTC中获得立即的现金收益。这种不利现金流量影响可能对公司的信誉产生负面影响and, in turn, harm its shareholders. Depending on state regulatory practices, the inability of a utility to use tax benefits efficiently instead may result in its customers' realizing significantly reduced value from tax incentives. Either way, the policy intention of the credits — to lower the cost of clean energy — is undercut.

Exhibit 1. Regulated iNvestor拥有的公用事业公司在2019年共同承担了足够的联邦税收责任,以建造4GW的太阳能和存储。我们将Berkshire Hathaway Energy排除在此分析之外,因为它在公用事业控股公司中具有重要的联邦税收负债的母公司来利用ITC和PTC。资料来源:FERC表1,RMI分析。

公用事业公司可以从第三方开发商或与税收股权投资者合作(一个大型金融或公司机构)购买清洁电力,该公司发现市场将其税收责任出售给可再生能源开发商 - 以实现税收优惠的收益。但是,第三方所有权和税收公平通常会带来较高的融资成本,从而减少可以将税收优惠的福利量减少。此外,这些安排与公用事业公司的核心业务模型有所不同,该模式是随着时间的推移而部署资本。

Public power agencies and many cooperative utilities are in a similar situation for different reasons. As not-for-profit entities, these utilities cannot directly use the tax benefits at all. Instead, these utilities must rely on private-sector developers and investors who can claim the tax credits to finance clean energy. As private entities, they have capital costs much greater than the government debt that not-for-profit utilities otherwise would use to finance fossil energy resources. This capital cost penalty significantly reduces or even eliminates the relative cost benefit from clean energy subsidized through tax incentives. As a result, the not-for-profit utilities that服务超过25%的美国客户从转向清洁能源方面的经济利益要低得多,即使是可比的营利性公用事业(有或没有税收能力)。

直接工资将消除这些差异。而且,这将大大提高公共电力,合作社和投资者拥有的公用事业的能力(共同负责煤炭的电力部门排放量的80%),从而为客户节省成本,从过渡到廉价,无碳电力。